With all the advancements in Value Stream Management, with its focus on clearly defining the business value of a digital product, the next step is the assembly of a Value Stream Portfolio (VSP) of multiple digital products that measure digital value across the entire enterprise. Technology teams have struggled for years to measure and communicate the positive returns on the investments in digital, and a well-designed VSP is a portfolio of value streams that can be used to compare and contrast the relative contribution of multiple digital products in terms that the business can readily understand.

The paper ‘IDC PlanScape: Value Stream Management to Drive a Digital Business Portfolio’ is an effort to explore how a Value Stream Portfolio can be assembled as a tool to define, measure, communicate, and make decisions around both digital product costs and value, with the ability to compare relative value stream contribution and performance across the enterprise.

At the heart of a new Value Stream Portfolio are three foundational concepts that will enable relative contribution to be compared:

- A common method and metric is needed to assess, assign, and compare the relative value of value streams

- A clear linkage is needed to connect value stream targets to the actual value they create in terms of KPI performance.

- A common method and metric is needed to measure the actual performance of a value stream to its connected KPIs

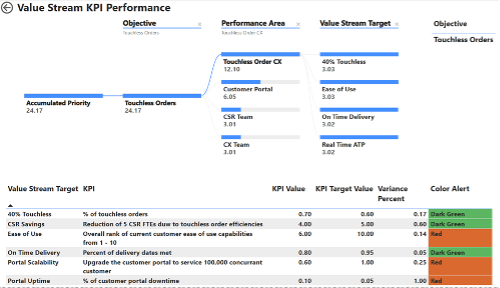

Figure 1, below, is a mockup of how a VSP can be developed using these three concepts. Each Value Stream Target (VST) is assigned a relative priority as a proxy for its value. Then these VST relative priorities flow into a Performance Area (Touchless Order CX) while accumulating their priorities. Finally each VST flows further to its Objective where the final Accumulated Priority is established: this becomes the relative priority of the objective. In addition, each VST is linked to an actual KPI linked to a business outcome. Actual performance is measured with a common metric (Variance Percent) with color alerts.

Figure 1 – Basic flow of value stream targets to their business objective (Source: IDC 2024)

Once the essential Value Stream Targets are established for the set of objectives, then further analysis can be performed to compare the value characteristics across the portfolio. It is at this point that cost must also be included in the calculus, and the total cost of each IT digital product needs to be ingested into the model. (If possible, costs should align to a VST in order to match cost to benefit).

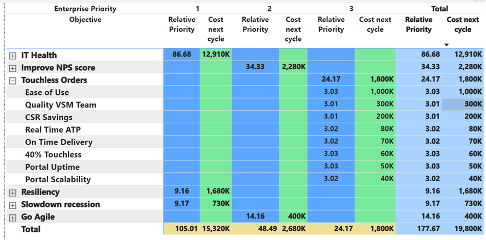

Below, in Figure 2, is a comparison of business objectives and their high-level enterprise priority: Enterprise Priority is assigned to an Objective with 3 being the dominant weight. As shown earlier, each objective accumulates a Relative Priority from its Value Stream Targets, and one can see how the Touchless Orders are drilled into by VST. Costs can then be associated with each VST. To maintain an adaptive planning position, costs should be addressed from the standpoint of approving only the next business cycle of resource funding, so that agility can be maintained with shorter and shorter time horizons.

Figure 2 – Comparison of Business Objectives by Value Stream Targets priority and cost (Source: IDC 2024)

From this position, every Value Stream Target can be assessed as to its relative contribution based on the cost-to-value relationship. While there is no perfect algorithm to assess the perfect scoring of relative contribution, transparency in itself creates the most value where management can easily see the value, cost, and tradeoffs in deciding to release funds.

There are probably many ways in which to bring value streams into an enterprise portfolio, and the article will step through this approach in more detail on how one method can be used to begin building a Value Stream Portfolio. It can start with only a few key objectives to prototype. There is probably no one solution on the market now that can support this type of portfolio, so it is up to each organization to develop (prototype) an agile solution customized to their needs and the available data of the enterprise.

To access the full IDC PlanScape: Value Stream Management to Drive a Digital Business Portfolio, become a Value Stream Management Consortium member. Find the paper here.

The Value Stream Management Consortium is a professional association funded by our members. Our purpose is to serve the burgeoning VSM community by creating space to share experiences and learn from one another. Together, we collaborate on the production of tools and utilities that drive the adoption of VSM practices that bestow business advantage. We aim to bring you VSM joy.

Bob Multhaup

Bob Multhaup is an Adjunct Research Advisor with IDC’s Research Network, focusing on IT business and financial management. He has had extensive experience as a CIO, including serving as the divisional information officer for two Sandoz divisions, as vice-president of IT for Henkel N.A. , and as vice-president of IT for Cognis Corp. In these positions, Bob worked in Europe managing large international IT organizations, developing strategic IT plans, aligning IT to business goals, and consolidating global IT costs and organizations. In 2004, Bob started a management consulting company based upon the ITin3D© cost modeling tool, which he invented. ITin3D© is designed to provide the CIO and IT management team with an in-depth understanding of IT service costs and the accurate distribution of these costs to the IT customers who consume IT services. These cost modeling principles are fully aligned with ITIL and ITSM service concepts and can be expanded beyond service-based costing to include mergers and acquisition integration models, data center migrations, unit-based cost determination and benchmarking, and IT budgeting and strategic scenario analysis. Bob has a bachelor’s degree from Brown University and an MBA in finance from Fairleigh Dickinson University. He has written numerous articles on the subject of IT value creation and service cost management.

Comments 0